— But Analysts Warn It May Be Too Much, Too Fast

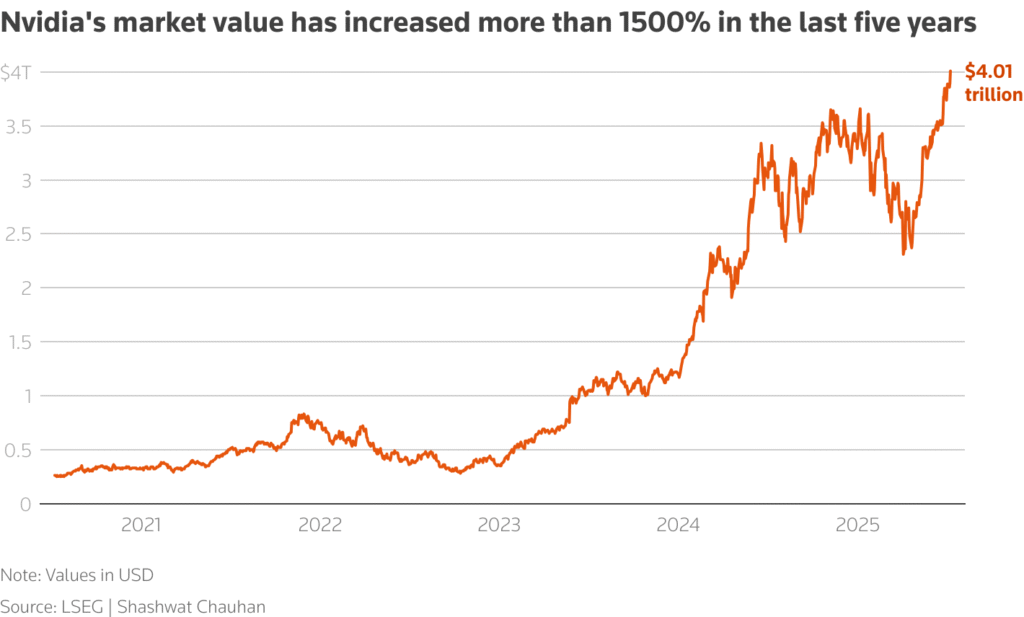

Nvidia just did what no other company in history has done — it officially crossed the $5 trillion mark in market value. That means the Nvidia market value now tops the combined worth of Amazon and Tesla, and even outpaces tech titans like Apple and Microsoft. It’s a number that sounds almost unreal, yet here we are, watching a chipmaker become the world’s most valuable company.

At the heart of this massive leap is Nvidia’s dominance in artificial intelligence (AI). Its powerful GPU chips have become the essential fuel for the global AI race, powering everything from ChatGPT to autonomous cars. This relentless demand has sent Nvidia stock soaring over the past few years, creating a market frenzy that few could have predicted.

But while the Nvidia market value continues to climb, not everyone is cheering. Some analysts say the company’s growth might be running ahead of its fundamentals, and the AI boom could slow down faster than many expect.

From Gaming Graphics to Global AI Powerhouse

It’s hard to believe that Nvidia started out in the late 1990s as a gaming graphics company. Back then, its claim to fame was creating GPUs that made PC games look incredible. Fast forward to 2025, and Nvidia has become the backbone of modern computing.

Every major AI company — from Microsoft and Google to Amazon and Meta — uses Nvidia’s hardware to train their large language models and generative AI tools. This massive industry dependence on Nvidia has driven its financial success. Over the past few years, Nvidia market value has increased more than tenfold, making investors ecstatic and rivals nervous.

At the center of this transformation is Jensen Huang, Nvidia’s co-founder and CEO. Known for his calm confidence and signature leather jacket, Huang has guided the company through two decades of industry shifts. His recent comment that Nvidia is on track to generate “half a trillion dollars in revenue” only added fuel to the hype.

Why Nvidia’s Market Value Keeps Climbing

So what’s driving this jaw-dropping rise in Nvidia market value? The answer lies in the perfect storm of AI adoption, high-performance computing, and limited competition.

Nvidia’s flagship GPU chips, especially the H100 and Blackwell processors, have become the industry standard. They’re fast, energy-efficient, and built to handle the massive workloads of AI training. Simply put, if a company wants to run large-scale AI systems, it’s probably using Nvidia hardware.

This dominance has allowed Nvidia to command huge profit margins. Its recent quarterly earnings smashed expectations, with revenue growth exceeding 250% year-over-year. Investors took notice, sending the Nvidia market value soaring past every major rival in record time.

But while that sounds great, there’s growing concern that the valuation may be outpacing reality.

The Warning Signs Behind the Boom

Several analysts are calling Nvidia’s surge “historic but risky.” The Nvidia market value reflects investor excitement around AI, but some fear it’s turning into a bubble.

For instance, Nvidia relies heavily on a handful of massive customers — including Microsoft, Amazon Web Services (AWS), and Google Cloud. If any of these players reduce their spending or develop their own chips, Nvidia’s revenue could take a big hit.

There’s also the risk of competition heating up. AMD and Intel are both racing to catch up with new AI-focused hardware. Even Amazon is developing custom chips for its cloud platform. Over time, these moves could chip away (pun intended) at Nvidia’s dominance.

Then there’s the geopolitical side of things. Nvidia manufactures many of its chips in Taiwan, which has become a flashpoint in global trade tensions. Any disruption in supply could shake investor confidence and drag down the Nvidia market value overnight.

Jensen Huang’s Vision: Half a Trillion Dollars in Revenue

Despite the warnings, Jensen Huang remains optimistic — even bold. He’s been vocal about Nvidia’s long-term goal: $500 billion in annual revenue. That’s roughly the size of Amazon’s current yearly sales.

Huang believes this is achievable because AI will soon touch every corner of the economy. From self-driving cars and healthcare imaging to smart factories and digital twins, Nvidia’s chips are powering the infrastructure of the future.

In other words, Huang isn’t just selling hardware — he’s selling the building blocks of the next industrial revolution. And for now, investors are buying that story in droves, helping push the Nvidia market value to unprecedented levels.

The AI Gold Rush: Is It Sustainable?

The AI industry’s rapid expansion has made Nvidia the poster child of this new era. But experts warn that the current pace of growth might not be sustainable forever.

AI adoption is still expensive. Training and running large models costs millions in computing resources, most of which go to Nvidia’s chips. Some startups and smaller companies are already struggling to afford the hardware needed to stay competitive.

If AI spending slows down — even slightly — it could ripple across the industry and put downward pressure on the Nvidia market value.

That’s why some analysts are cautious. They argue that Nvidia’s success is built on a once-in-a-generation tech boom. If that boom cools, Nvidia could find itself facing the same fate as past tech darlings that rose fast but fell faster.

Market Reactions: The $5 Trillion Debate

Wall Street can’t stop talking about it. Nvidia’s valuation has triggered heated debates among investors, with opinions split right down the middle.

Some see it as the ultimate validation of AI’s potential — the dawn of a new computing age. Others say it’s a classic case of “irrational exuberance.”

Still, as long as Nvidia keeps posting record profits, it’s hard to argue against the numbers. The Nvidia market value might seem extreme, but for now, it’s backed by growth, demand, and hype — a powerful trio in the stock market.

What Happens Next

So, where does Nvidia go from here?

If AI continues to expand as expected, Nvidia’s dominance could strengthen even further. The company has already started diversifying, investing in software platforms, AI data centers, and even partnerships with car manufacturers.

But if competition rises or the AI market slows, the Nvidia market value could stabilize — or even drop. It’s the nature of tech cycles: what rises fast can fall just as quickly.

That said, Nvidia has weathered downturns before. Each time, it’s emerged stronger. So while investors should be cautious, writing Nvidia off now would be a mistake.

Final Thoughts: Too Much, Too Fast?

Nvidia’s journey from a gaming graphics startup to the world’s first $5 trillion company is nothing short of extraordinary. The Nvidia market value reflects not just one company’s success, but a global shift toward AI-driven innovation.

However, history tells us that even the brightest stars can fade. As competition heats up and markets mature, Nvidia will have to prove it’s more than just the face of an AI bubble.

For now, though, it stands at the top — a symbol of how fast the world can change when technology and ambition collide.

For more such stories please visit us @Brnd Guru